How Long Do You Depreciate Manufacturing Equipment . ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. Find out the key values you need to. it is a reality that all manufacturers face: — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. Equipment wears over time, depreciating in value each year.

from dxobuwzlr.blob.core.windows.net

learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. Find out the key values you need to. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. it is a reality that all manufacturers face: — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. Equipment wears over time, depreciating in value each year.

How Do You Depreciate Equipment at Buford Morrell blog

How Long Do You Depreciate Manufacturing Equipment — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. Find out the key values you need to. Equipment wears over time, depreciating in value each year. — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. it is a reality that all manufacturers face:

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Do You Depreciate Manufacturing Equipment Equipment wears over time, depreciating in value each year. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. Find out the key values you need to. ias 16, property, plant and. How Long Do You Depreciate Manufacturing Equipment.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow How Long Do You Depreciate Manufacturing Equipment — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. Find out the key values you need to. — depending on maintenance and usage, manufacturing equipment. How Long Do You Depreciate Manufacturing Equipment.

From quickbooks.intuit.com

What is depreciation and how is it calculated? QuickBooks Global How Long Do You Depreciate Manufacturing Equipment ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. — by thoroughly comprehending. How Long Do You Depreciate Manufacturing Equipment.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow How Long Do You Depreciate Manufacturing Equipment Find out the key values you need to. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment. How Long Do You Depreciate Manufacturing Equipment.

From ramsayroddy.blogspot.com

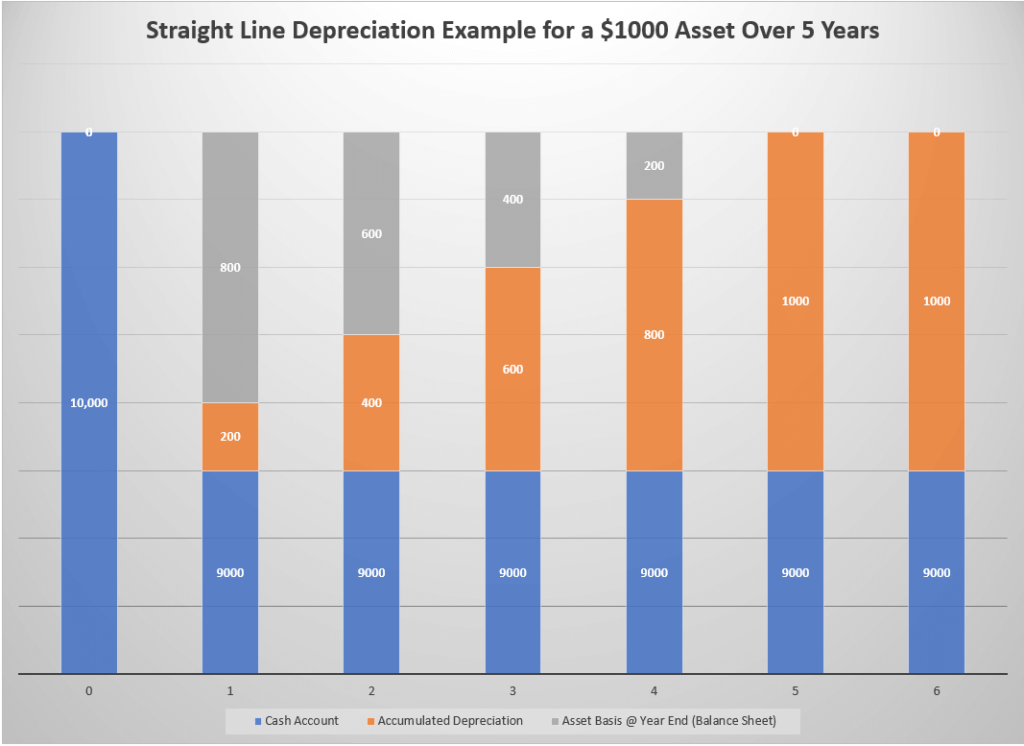

Straight line method of depreciation example RamsayRoddy How Long Do You Depreciate Manufacturing Equipment Equipment wears over time, depreciating in value each year. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. Find out the key values you need to. — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate.. How Long Do You Depreciate Manufacturing Equipment.

From exocbnyxt.blob.core.windows.net

How Long Can You Depreciate Business Equipment at Dayna Franco blog How Long Do You Depreciate Manufacturing Equipment Equipment wears over time, depreciating in value each year. Find out the key values you need to. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — depending on. How Long Do You Depreciate Manufacturing Equipment.

From gocodes.mightybox.site

What Is Equipment Depreciation and How to Calculate It How Long Do You Depreciate Manufacturing Equipment learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. Find out the key values you need to. — if ppe corp expects to use the equipment in its operations. How Long Do You Depreciate Manufacturing Equipment.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Do You Depreciate Manufacturing Equipment — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. Find out the key values you need to. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. it is a reality that all manufacturers face: — by thoroughly comprehending equipment depreciation,. How Long Do You Depreciate Manufacturing Equipment.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Do You Depreciate Manufacturing Equipment it is a reality that all manufacturers face: — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. Equipment wears over time, depreciating in value each year. learn what equipment depreciation is, why it matters for your business, and how to calculate it using four. How Long Do You Depreciate Manufacturing Equipment.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Do You Depreciate Manufacturing Equipment gaap doesn't require you to peer into the future and know how long you'll use a particular asset. it is a reality that all manufacturers face: — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere. How Long Do You Depreciate Manufacturing Equipment.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Do You Depreciate Manufacturing Equipment — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. it is a reality that all manufacturers face: Equipment wears over time, depreciating in value each year. ias 16, property, plant and equipment,. How Long Do You Depreciate Manufacturing Equipment.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow How Long Do You Depreciate Manufacturing Equipment learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. Equipment wears over time, depreciating in value each year. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. — depending on maintenance and usage, manufacturing equipment like heavy machinery. How Long Do You Depreciate Manufacturing Equipment.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow How Long Do You Depreciate Manufacturing Equipment Equipment wears over time, depreciating in value each year. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. Find out the key values you need to. — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. gaap doesn't require you to peer into the future. How Long Do You Depreciate Manufacturing Equipment.

From www.wikihow.com

How to Calculate Depreciation on Fixed Assets (with Calculator) How Long Do You Depreciate Manufacturing Equipment learn what equipment depreciation is, why it matters for your business, and how to calculate it using four methods. — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. Equipment wears over time, depreciating in value each year. ias 16, property, plant and equipment, requires. How Long Do You Depreciate Manufacturing Equipment.

From haipernews.com

How To Calculate Depreciation Cost Of Machinery Haiper How Long Do You Depreciate Manufacturing Equipment — depending on maintenance and usage, manufacturing equipment like heavy machinery can last anywhere from. Find out the key values you need to. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and. How Long Do You Depreciate Manufacturing Equipment.

From exocbnyxt.blob.core.windows.net

How Long Can You Depreciate Business Equipment at Dayna Franco blog How Long Do You Depreciate Manufacturing Equipment ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. Find out the key values you need to. — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. — depending on maintenance and usage, manufacturing equipment like. How Long Do You Depreciate Manufacturing Equipment.

From haipernews.com

How To Calculate Depreciation Schedule Haiper How Long Do You Depreciate Manufacturing Equipment it is a reality that all manufacturers face: — if ppe corp expects to use the equipment in its operations for only the next 12 months, ppe corp should depreciate. — by thoroughly comprehending equipment depreciation, you can make informed decisions about equipment replacement, appropriate insurance. ias 16, property, plant and equipment, requires entities to review. How Long Do You Depreciate Manufacturing Equipment.

From theasphaltpro.com

AsphaltPro Magazine AsphaltPro Magazine Know When, How To Depreciate How Long Do You Depreciate Manufacturing Equipment Find out the key values you need to. Equipment wears over time, depreciating in value each year. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. gaap doesn't require you to peer into the future and know how long you'll use a particular asset. learn what equipment depreciation. How Long Do You Depreciate Manufacturing Equipment.